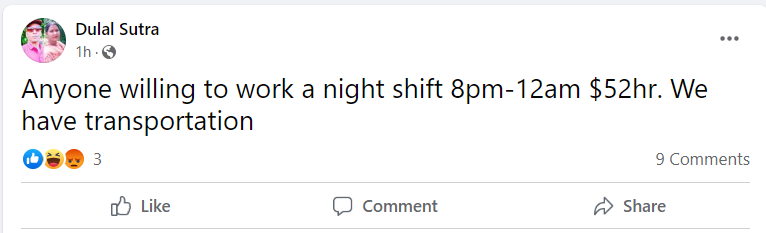

You have probably seen the job listings on Facebook recently. “Driver needed. 35 hrs per week. $100,000”. “Anyone willing to work a night shift 8pm – 12am. $52hr. We have transportation”.

In reality, there are no “late shift” or “drivers needed” jobs. These are just the latest in “Imposter Scams” tracked by the Federal Trade Commission. In just the first and second quarters of 2022, Americans have lost over $1.3 billion dollars to scammers.

According to the FBI’s Internet Crime Complaint Center (IC3), in 2020, Texas reported 1,720 victims with a reported $4.5 million in losses. There were 69 victims in El Paso totaling $721,600 in losses. In El Paso, there were eight victims reporting $31,928 in losses. Midland/Odessa reported 10 incidents in 2020 totaling $71,500. The average reported loss was nearly $3,000 per victim, in addition to the damage to the victims’ credit scores.

The examples given above outline simply the entry point of this gigantic fraud scheme that can get quite intricate and encompassing.

A link is provided to a victim either through Facebook, Linked In, email, or Instant Messenger to a very legitimate-looking Job board, employer, or recruiter website. Occasionally, they are even (very sophisticated) spoofed versions of websites such as Indeed.com.

How they get you there is really not important, what’s important is that once you are there you will need to fill out the employment application … just as in every job you have ever applied for. Once you start typing your information you are already headed into the abyss.

In no time they will have just about everything they need to steal your identity. Name, address, phone number, email address. Work history…. Those are easy and most people will give that information away freely.

If you clicked on a link from Facebook they already have your social media account and will instantly start downloading your profile pictures or anything else they might need to create a “fake” account with your name on it. With that, they will spoof your friends. But YOU will be blocked so that you can’t see what they are doing.

When it comes to that “Driver” job … well for that you will, of course, have to enter your driver’s license number … “For insurance purposes” you are told. And of course, you will have to fill out the W4 form (giving them your social security number) in order to have the proper taxes deducted from your check, of course.

Once you are on the hook no matter what happens from here on out you are already a victim … you just don’t know it yet.

In some cases, they might just ghost you from this point forward. Walking away with your information and setting you up for identity theft and stealing every dime from you. Days later you are left wondering what ever happened to that job. When you try to contact them your inquiries go unanswered.

A few of them go even further.

They tell you that you will need to pay a small processing fee for the application. Or perhaps it is a referral fee to the recruiter. It might be a fee as low as $4.99 or as high as $24.99… or more. At this point, they may have already run your credit (and stored that information for later use) and figured out how much they think they can scam you. Once you agree to pay, now they also have at least one credit card.

From here they have full reign to do just about anything they want with your identity. But the latest scam, as reported in propublica.org is one that you might not even be aware of… Unemployment Insurance Fraud.

In February 2021, the U.S. Department of Labor issued an Alert that stated that they had identified upwards of $5.4 billion in potentially fraudulent Unemployment Insurance benefits.

“A Bronx man allegedly received $1.5 million in just ten months. A California real estate broker raked in more than $500,000 within half a year. A Nigerian government official is accused of pocketing over $350,000 in less than six weeks.

What they all had in common, according to federal prosecutors, was participation in what may turn out to be the biggest fraud wave in U.S. history: filing bogus claims for unemployment insurance benefits during the COVID-19 pandemic.” writes, Cezary Podkul with Propublica.

By the time the jobless claims ended in September 2021, the U.S. Department of Labor’s inspector general estimates that at least $87 billion in fraudulent and improper payments will have been paid.

The Federal Trade Commission has stated that in 2021, “Government documents or benefits fraud” was the most prevalent type of identity theft case — more than 395,000 people reported that someone submitted a fraudulent government document under their name. This number represents a 70% spike over 2020 numbers.

So when you witness those seemingly benign Facebook posts about a “Driver needed” or “Late shift workers” be sure to not only report the post as Spam or Fraud but also block them.

The FBI recommends the following tips to protect yourself:

- Conduct a web search of the hiring company using the company name only. Results that return multiple websites for the same company (abccompany.com and abccompanyllc.com) may indicate fraudulent job listings.

- Legitimate companies will ask for PII and bank account information for payroll purposes AFTER hiring employees. This information is safer to give in-person. If in-person contact is not possible, a video call with the potential employer can confirm identity, especially if the company has a directory against which to compare employee photos.

- Never send money to someone you meet online, especially by wire transfer.

- Never provide credit card information to an employer.

- Never provide bank account information to employers without verifying their identity.

- Do not accept any job offers that ask you to use your own bank account to transfer their money. A legitimate company will not ask you to do this.

- Never share your Social Security number or other PII that can be used to access your accounts with someone who does not need to know this information.

- Before entering PII online, make sure the website is secure by looking at the address bar. The address should begin with “https://”, not “http://”.

- However: criminals can also use “https://” to give victims a false sense of security. A decision to proceed should not be based solely upon the use of “https://”.